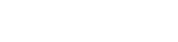

Get Started in 3 Easy Steps

Ready to explore DeFi? AstraBlox brings together top DeFi tools, with future access to regulated offerings for accredited investors — all from one platform.

1. Register on AstraBlox

1. Register on AstraBlox

Create your AstraBlox account to unlock access to DeFi tools and portfolio features. Signing up is fast and secure.

2. Create Your Web3 Wallet

2. Create Your Web3 Wallet

Through Fireblocks integration, you can create a built-in segregated wallet directly within the AstraBlox interface.

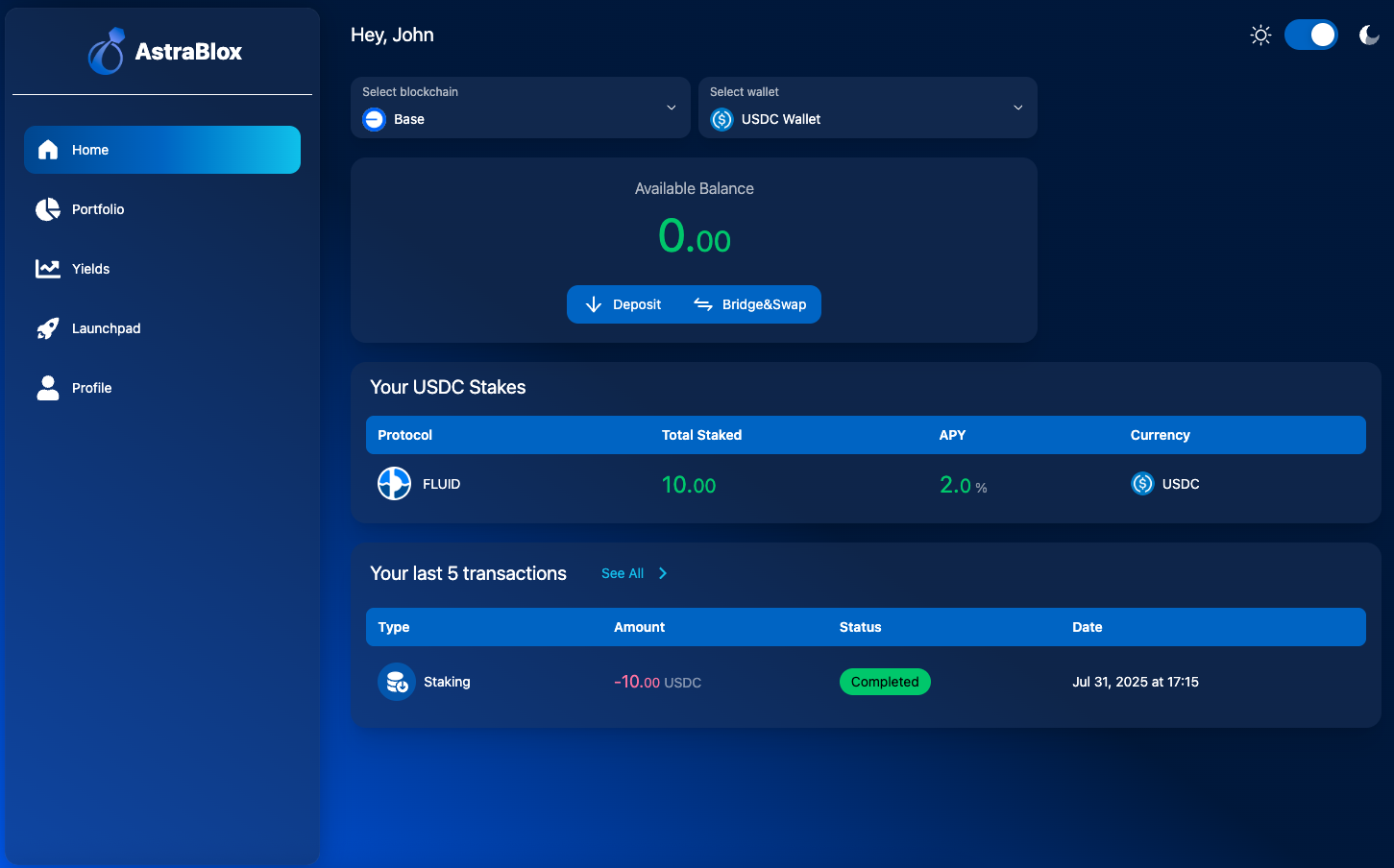

3. Deposit Your Crypto

3. Deposit Your Crypto

Fund your wallet with supported digital assets to start exploring bridges/swaps, staking, and other DeFi opportunities when available.

Powerful Solutions for All

Innovative B2B Solutions

You bring the vision, AstraBit brings the infrastructure—power your business with professional tools for digital asset trading, compliance, and informed decision-making.

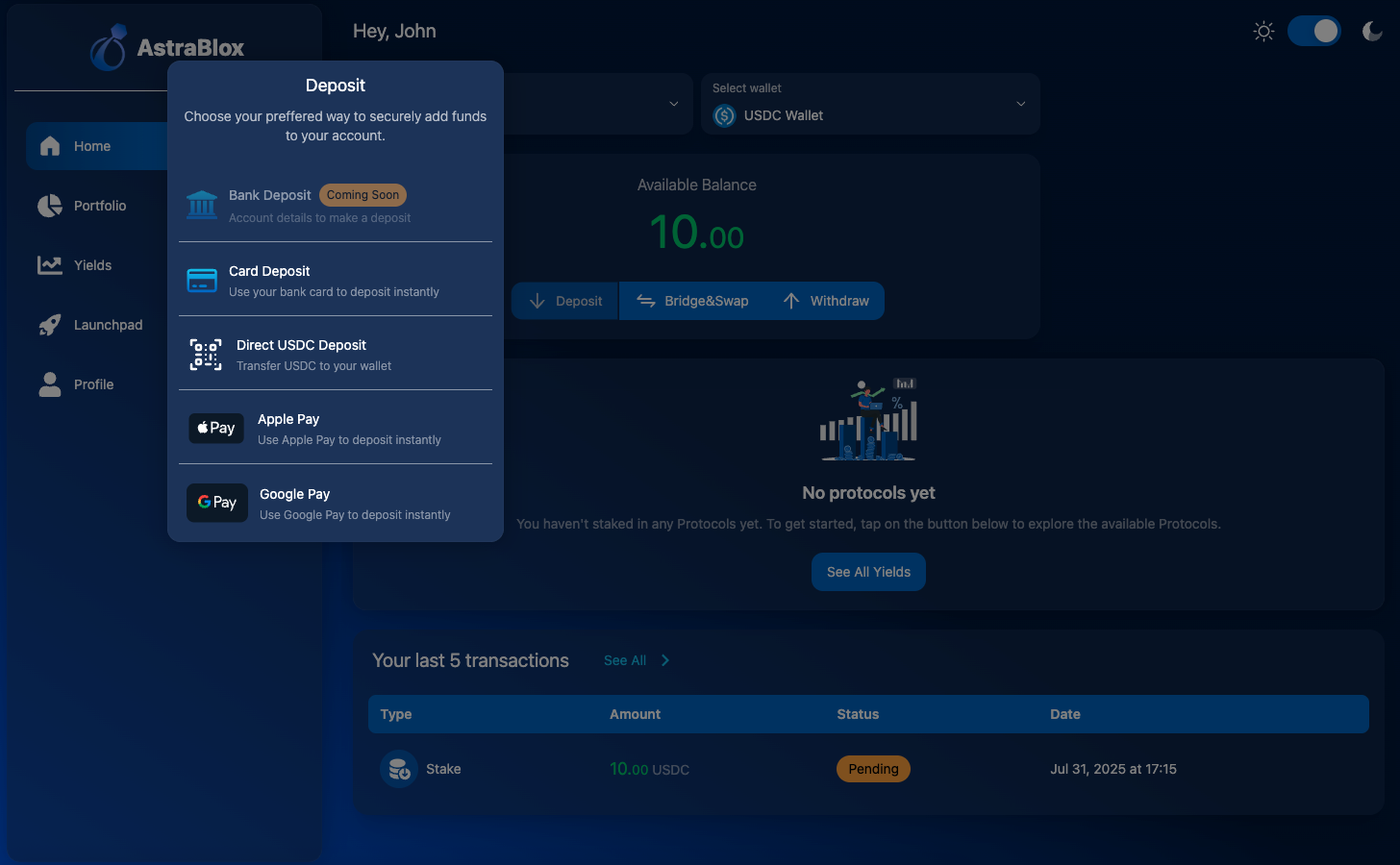

Yield Strategies

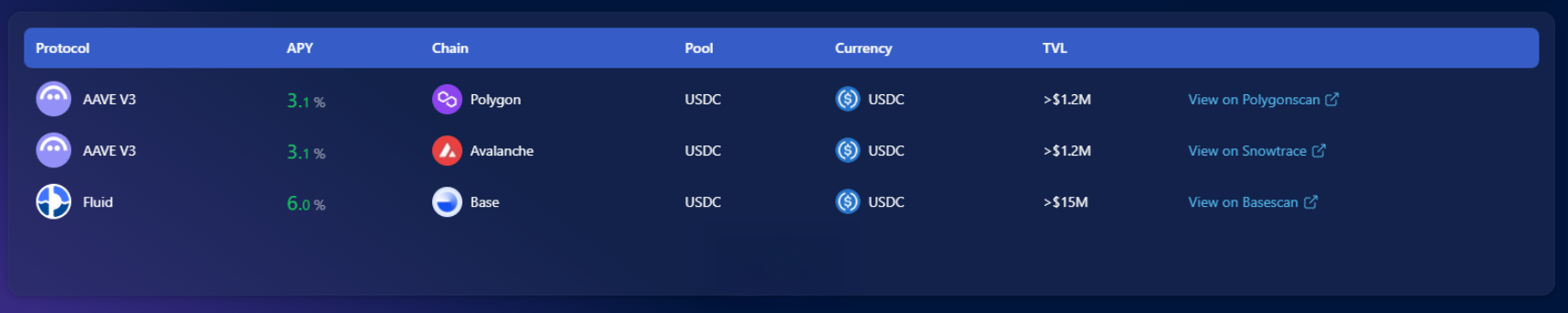

With AstraBlox, you can access on-chain yield strategies through established DeFi protocols. Explore opportunities for staking and liquidity provision across multiple blockchains, with details on pools, assets, and network activity.

Each strategy displays protocol information, APY (for informational purposes only), supported currencies, and chain data to help you evaluate options. From stablecoin staking to higher-yield liquidity pools, AstraBlox offers visibility to align with your portfolio and risk preferences. Learn more about yield strategies on our blog.

The displayed APY is for informational purposes only and may not reflect actual returns. Rates are subject to change at any time without notice.

Connect to the World of DeFi

Power your DeFi journey with broad network connectivity, token support, and enterprise-grade integrations.

Connected Networks

Tap into leading blockchain ecosystems for swaps, bridges, staking, and tokenized assets.

Supported Tokens

Trade, bridge, or stake across supported networks with cross-chain assets.

Integrated Protocols & Providers

Infrastructure partners powering swaps, bridging, staking, and secure operations behind the scenes.

Frequently Asked Questions

What is AstraBlox?

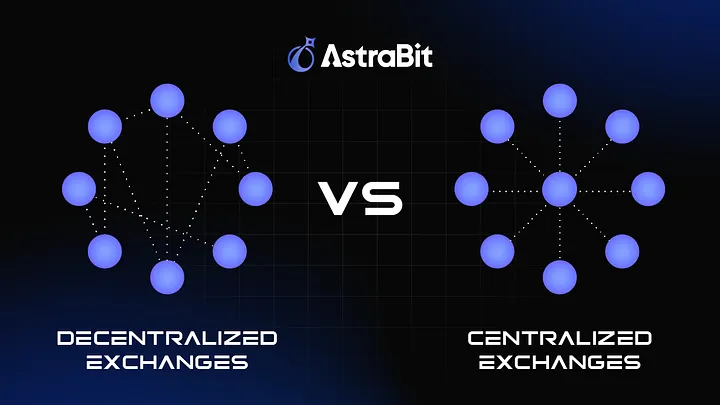

AstraBlox is a decentralized application (dApp) platform that provides access to on-chain finance tools for token swaps and bridging, yield staking, and real world asset tokenization via private placement and vault funds. Investors interact with a curated suite of on-chain investment products in an intuitive and secure manner for both retail and institutional investors alike.

What is RWA tokenization?

RWA tokenization converts real-world assets like equity, debt, real estate, or commodities into digital asset tokens on the blockchain. This process enables fractional ownership and integration with decentralized finance protocols.

What is validator node staking?

Validator node staking involves locking tokens in a blockchain network to help validate transactions and secure the network. Participants may receive protocol-level rewards based on the network’s rules. AstraBlox enables staking directly on supported blockchains through wallets created within the platform, secured by Fireblocks.

What is yield farming?

Yield farming involves deposit of digital tokens into automated market maker (AMM) and yield-aggregator like platforms that are seeking to incentivize liquidity for participation in their liquidity pools. Stakers may participate in trading fees or other incentives, depending on provider rules.

What is yield staking?

Yield staking involves locking or delegating single digital asset tokens within staking contracts to earn rewards in the same staked native digital asset asset token over time. Rewards depend on the specific staking protocol’s rules.

What is the AstraBlox Launchpad?

The AstraBlox Launchpad supports projects seeking to tokenize their real world equity and bring participation in these equity offerings on-chain. Similar to an Initial Coin Offering (ICO) or Token Generation Event (TGE), this allows real world issuers to open participation in their offerings to on-chain liquidity sources. Participation in these tokenized offerings may involve 501 accreditation for US investors.

How do I connect my Web3 wallet?

AstraBlox provides users with policy-controlled MPC Wallets via Fireblocks. The provisioned MPC wallet supports a growing diverse set of networks and protocols. Users can on-ramp fiat to crypto to fund their accounts or deposit funds from external wallets.

What networks are supported?

Currently supported networks include:

- Ethereum

- Base

- Avalanche

- Polygon

- Binance Smart Chain

Networks planned for future integration include:

- Arbitrum

- Gnosis Chain

- Sui Network

What tokens can I use?

Supported tokens currently are:

- ETH (Ethereum)

- USDC (USD Coin)

- EURC (Euro Coin)

Additional tokens will be added as new network integrations go live.

→ To learn more, visit our [AstraHelp Center Article]

How do bridge and swap services work?

- Token Bridging: Move assets from one blockchain to another by transferring them from a source chain and minting equivalent tokens on a destination chain, i.e., bridging USDC from Ethereum to USDC on Base.

- Token Swaps: Enable the transfer of one type of token to another token type within the same blockchain using decentralized liquidity pools, i.e., swapping USDC on Base for ETH on Base.

AstraBlox leverages third-party integrations like Li.Fi to support finding the best optimal routes for fees and slippage to support both bridging and swap activities.

Do you provide on/off-ramp services for fiat currency?

Yes. Through third-party providers, AstraBlox supports investor on- and off-ramp services to quickly convert your fiat from your bank account or payment card to digital asset tokens in your wallet, or vice-versa. All on-/off-ramp services are subject to provider availability and local investor regulations.

Do I need to complete KYC?

Yes. AstraBlox is a member regulated firm of FINRA. Consistent with this designation, AstraBlox requires all investors to undergo basic KYC verification involving a liveliness check, verification of a recognized proof of identity, and proof of address submission. Verifying on one platform will grant access to all AstraBit / AstraBlox products and services at the appropriate KYC tier. Access to some products and services may require additional levels of KYC verification.

→ To learn more, visit our [AstraHelp Center Article]

Why is KYC required for all services?

KYC verifies user identities, prevents illicit activity, and ensures compliance with applicable laws. As a FINRA regulated firm, AstraBlox must enforce KYC across all products and services.

Is AstraBlox custodial or non-custodial?

AstraBlox employs Fireblocks as its wallet solution provider using the pure self-custody Embedded Wallet

Service. EWS wallets are pure self custody wallets. Investors provision their own EWS wallet with

Fireblocks. EWS wallets employ multi-party computation MPC technology between the investor and

Fireblocks. AstraBlox does not maintain a key share in this process. All investors are required to store and

retain their own EWS wallet passphrase information. EWS wallets can be exported to any other wallet

provider of their choosing, e.g., Metamask.

What fees apply when using AstraBlox?

Fees depend on the service used and may include:

- Network (gas) fees for blockchain transactions

- Protocol or liquidity provider fees for swaps, bridges, or staking

- Withdrawal fees, if applicable

A full fee schedule is provided before confirming each transaction.

Which wallets are compatible with AstraBlox?

Currently, AstraBlox integrates with Fireblocks, allowing users to create built-in segregated wallets directly on the platform. Additional wallet providers may be added over time, this may include embedded wallets via Fireblocks that allow investors to bring their own wallet.

→ To learn more, visit our [AstraHelp Center Article]

Compliance at Our core

SEC & FINRA Registered

AstraBit is a registered Broker-Dealer and FINRA member firm dedicated to compliance and accountability with US regulation.

Secure API Connections

All integrations use permissioned, read-only API keys designed to help safeguard trading data and account access.

Non-Custodial by Design

AstraBit never holds or controls your funds. You maintain custody of your assets.

Built With Regulatory Oversight in Mind

AstraBit is structured to align with regulated environments, prioritizing transparency, security, and operational clarity.

Direct Support From Our Team & Partners

Access real-time assistance from the AstraBit team, our partners, and the broader community.

AstraBlog: Explore Recent Topics in The news, Trading & deFi

Insights, updates, and trends in the digital asset space.